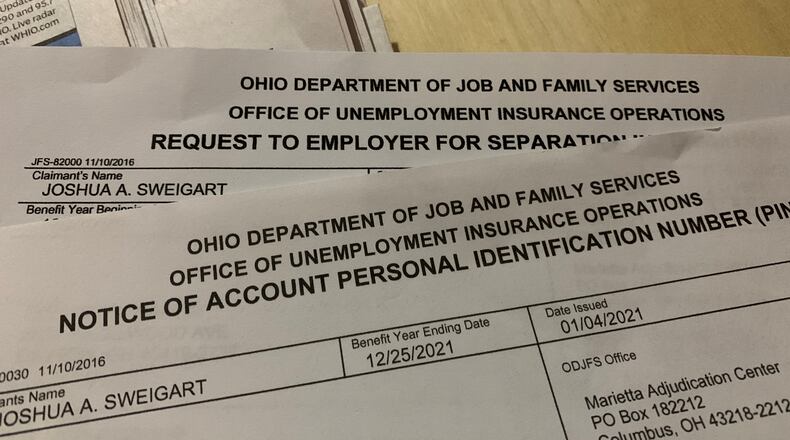

Credit: DaytonDailyNews

“Today, and for the last several weeks, we are seeing issues with less than 4% of total new and continued claims, a substantial reduction from the almost 20% on average we were seeing early in the year,” ODJFS spokesman Tom Betti said Friday in response to questions from the Dayton Daily News.

ODJFS estimates it paid out $21 million in fraudulent payments and $457 million in non-fraudulent overpayments through the traditional unemployment program from the beginning of the pandemic through the first quarter of 2021. This includes extra weekly Federal Pandemic Unemployment Compensation program payments the state ended last month.

In Pandemic Unemployment Assistance — the program for part-timers, the self-employed, gig workers and others who did not qualify for traditional unemployment — the state estimates it lost $443 million to fraud and $1.5 billion in non-fraud overpayments through April 2021. This also includes FPUC payments.

Betti said ODJFS formed a coalition of state and federal law enforcement agencies, headed by former U.S. Attorney David Devillers, “to pursue and bring to justice the criminals that have defrauded the state and its citizens over the last 18 months.”

The reduction in suspected fraud was the result of a public-private partnership Ohio launched this year to stem fraud, clear an unemployment claims backlog and improve customer service. Betti said the the backlog of non-fraudulent claims was eliminated and the call center answer rate is now 90 percent, the highest since the pandemic began.

Lexis exec on fraud findings

Central to the fraud-prevention effort was LexisNexis, which the state hired to implement fraud screening measures, such as maintaining a database of the electronic signature of devices used to commit fraud.

Haywood Talcove, CEO of LexisNexis Risk Solutions Government Division, said it identified 1,900 devices used in over 80,000 attempted unemployment transactions in over 40 states.

“They were all based in either Nigeria or Russia,” he said.

Lexis also used its public records databases to identify questionable claims. They found and stopped an instance where the address of a home that was for sale in Ohio was used by more than 400 applicants, Talcove said.

He said they also used technology to identify email “tumbling,” where fraudsters will use fake email addresses to intercept communication from applicants and direct them to an email they control. Talcove said they found over 11,000 instances of tumbling in Ohio.

Talcove praised Ohio for partnering with the private business community, which has been fighting sophisticated fraud for years. He said credit card companies lost about $3 billion to this type of fraud last year, while he estimates U.S. unemployment agencies lost closer to $250 billion.

“The government just wasn’t ready, but Ohio did a great job in that process. They are now one of the leaders in that space,” he said. “What that governor did in that state is what every governor should have done.”

He said while there is still some attempted fraud in Ohio, the international fraudsters have left Ohio and are focusing on state like California, New York and Florida that don’t have the same measures in place.

The U.S. Department of Labor has not estimated an improper payment rate for expanded unemployment because of the COVID pandemic. Based on pre-pandemic overpayment rates of 10% — which the feds concede are far lower than what they saw during the pandemic — the DOL Office of Inspector General estimates overpayments of more than $87.3 billion, “with a significant portion attributable to fraud.”

An OIG report released in May found states struggled to implement expanded unemployment during the pandemic. Many states didn’t perform necessary improper payment detection and recovery efforts, it said — 40% of states didn’t perform required cross-matches and 38% did not perform required recovery activities. And 42% of states didn’t properly report overpayment to the federal government.

The concern now, Talcove said, is that criminals will take the success they had at unemployment fraud and attack other government benefits programs — such as child tax credit payments scheduled to start going out this month.

“These (fraud detection) systems need to get set up everywhere or they are going to exploit these tax dollars,” he said.

About the Author