State Rep. Daniel Troy, D-Willowick, introduced HB 207 in March. It was referred to the House Ways & Means Committee and received a second hearing May 18.

It would raise the standard homestead exemption from the first $25,000 of a qualifying home’s value to $31,200, and raise the income cutoff for qualifying to $37,500, according to the Ohio Legislative Service Commission. It would also let the exempted value increase annually, indexed to inflation.

State Rep. Jason Stephens, R-Kitts Hill, and state Rep. Jeff LaRe, R-Violet Twp., introduced House Bill 357 in June. It was referred to the House Ways & Means Committee and had its first hearing Oct. 12.

It would simply index the current homestead exemptions to inflation, helping those on fixed incomes keep up with rising real estate taxes.

Homestead exemptions save eligible taxpayers an average of about $500 each per year, according to LaRe. In 2020, 764,000 Ohio properties got a homestead exemption, according to the Ohio Department of Taxation.

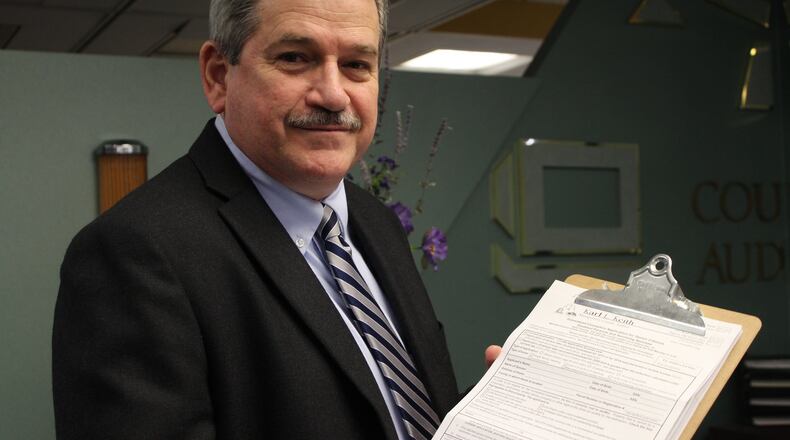

Montgomery County has about 138,000 owner-occupied properties, of which roughly 38,600 — or 28% — currently receive a homestead exemption, Brill said. But that exemption’s value has dropped by 18% since 2007, the last year the law changed. That decline is due to rising property values and new tax levies, according to Keith’s office.

The number of Montgomery County homeowners qualifying for an exemption has also gone down from a high point of 48,566 in 2014, when a cap on income was established for the standard exemption.

According to the Legislative Service Commission, the standard homestead exemption waives taxes on the first $25,000 in value on the primary residence of an owner who:

- Is at least 65 years old;

- Is permanently and totally disabled; or

- Is at least 59 years old and is the surviving spouse of a previous exemption recipient.

Homeowners who began getting the standard exemption in tax year 2014 — or tax year 2015 for those who pay the manufactured home tax — must have an Ohio modified adjusted gross income of $34,200 or less to qualify. That includes all business income but excludes Social Security and disability benefits. That income cutoff increases each year with inflation.

Those who got the standard exemption before 2014 have no income limit to qualify.

There is also an exemption on $50,000 in value for:

- Military veterans who are totally disabled;

- Surviving spouses of disabled veterans; and

- Surviving spouses of police, firefighters or other emergency responders who died in the line of duty.

No income limit applies to this exemption.

“The amount of the tax savings depends on the local tax rate: The higher the tax rate, the greater the tax reduction,” the commission’s bill analysis says.

Increasing the exempt value from $25,000 to $31,200, and indexing it to future inflation, would probably raise the average tax deduction by about 25%, according to the analysis.

Through the 2013 tax year, all Ohio homeowners 65 and older could exempt $25,000 value of their primary residences from property taxes, according to the Legislative Service Commission. So could the permanently disabled and surviving spouses of qualifying homeowners.

But nondisabled people who turned 65 in 2014 and afterward could only get the exemption if they were also low-income; the current cutoff is $34,200.

Totally disabled veterans were exempt from the income test on their $50,000 exemption.

Statewide, the number of qualifying homeowners has declined from a high of 930,000 in tax year 2013, and that is expected to continue under current law, the commission’s analysis found.

Hiking the income cutoff to $37,200 would let another 22,000 homeowners qualify, but then the total number of exemptions would likely resume their drop.

About the Author